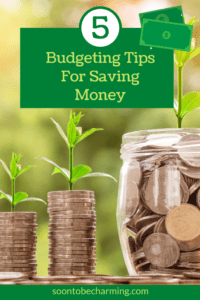

5 Budgeting Tips For Saving Money

Your standing at the checkout and you feel like you stayed on budget, but the register amount keeps going up and up! I’ve been there, it is frustrating when you try to stick to a budget and you fail. The grocery store is one of the toughest places to control. Maybe it’s Costco or Target for you? Either way, it’s time to get focused! Now before we get too far, this post, 5 Tips to creating a budget, is definitely not a fix all. However, the more you budget the more you can anticipate your spending and needs. If you are a beginner, it will get easier. If you are a veteran, sometimes you get complacent and need to refocus. These budgeting tips will help for anyone trying to stick to a budget!

Budgeting Tip #1: Work With Consistent Numbers

With the next breath, I am sure you are saying how is that going to work? My income is not the same each week or my bills are never the same, and the list goes on. I get it…so how do you work with consistent numbers. Here are a few budgeting tips to do that.

Income

Let’s start with income! If you have very inconsistent income from week to week or even month to month, it may take a little extra effort to get your numbers. What you need to do is take your lowest weekly amount or your lowest monthly amount and budget off that number. A budget won’t work if you base your income on an amount that is not met every time. We can work with more income in a certain week or month, but it makes it very difficult if you budget out the month and then do not have enough income.

In order to get this number, I recommend looking at paystubs and w2’s to see what income amount is met every week or month.

Bills

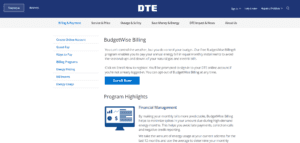

We have many of our bills on budget plans, like gas and electric. This makes the bills the same amount every month, even though we may use more gas in the winter than the summer. Many companies offer these types of services. If you have never heard of utility budget plans, then you should check into your providers and see if they offer them. It really helps you budget when the bills are the same each month.

Cable and phone bills are typically around the same amount each month, so we do not do any budget plans with those bills.

Personal Expenses

I have 6 family birthdays in June, but none in September…how do I budget that consistently? For items such as clothing, birthdays, Christmas (yes Christmas!), we budget all year round. We create a line item that rolls over, then even if we spend $200 in June it doesn’t effect the budget. The money is already in there.

The same idea goes for clothing. September hits and the kids need all new coats, shoes, and jeans. If you budget money all year round, then come fall, pull out what you need because it is already there.

Christmas is a another big one! Make a list of everyone you typically buy for, how much you spend then divide it by twelve. Then by December you’ll have all the money you need, without the panic.

One other idea would be a school line item. I actually don’t budget money consistently into a school line item, but I might start because it would be helpful! This line item could cover hot lunch, school pictures, field trips and other school expenses that come up. Again to figure out how much you should budget monthly, add up all the things you would spend on school in a year and divide by twelve.

Budgeting Tip # 2: Write Down What You Forget To Budget

Creating an accurate budget takes time and a lot of adjustment over the months and years. Some expenses, like my Amazon prime bill, only come once a year. It took me about two years before I actually remembered to budget it in! As much as I think I will remember everything, I just don’t! To help, I began keeping a list of all the items I forgot to budget. Then the following year I can reference the list and make sure I have everything added that I need. The more you write down, the better you can budget things accurately in the future. That is an important budgeting tip!

I created a sheet for you to use! CLICK HERE to get your free budget sheet. Remember this sheet is only for the items you tend to forget. Maybe items that you only need to budget once a year, like school pictures.

Budgeting Tip #3: Figure Out Your Struggle Areas

If you are having a hard time sticking to a budget, take a close look at it! Are you over in the same areas each month? If so, why? One reason might be that your numbers are not realistic for your situation. For instance, I have a family of 5. I could budget $250 in for groceries, but the chances of me sticking to that budget is almost impossible. Realistically, $400-$500 would be more like it.

Another reason might be simply overspending. I find it very easy to fall into this category, especially if I am not being intentional with my spending. If I just go into the grocery store and don’t keep track of what I am buying, even with a list, chances are I will come out over budget.

Personally, I would say my two biggest struggles are groceries and restaurants. Once you figure out your struggle areas, you can keep a better eye on them. For groceries, I have used a grocery budget app to add everything up as I put items in the cart. This helps me stay on budget. Shopping online for groceries can also be a huge benefit for budgeting, especially with many of the fees waived right now. You can see your exact total and remove items if you are over.

I wish I could say that it’s easy to overcome your struggle areas, but sometimes it’s not. If I grocery shop in a hurry or when I ‘m tired I might overspend. I have to be very intentional with my struggle areas to stay on track with my budget.

Lastly, your husband and you may have different struggle areas. If that is the case, help keep each other accountable. Even knowing someone will ask or check on what you are spending helps!

Budgeting Tip #4: Use Cash

You can’t spend money you don’t have, unlike plastic. I have literally watched the conveyor belt move forward and the total continue going up until I had to start pulling items off the belt. It stinks! However, the feeling of staying on budget when you walk out of the store doesn’t!

We commonly use cash for Groceries, restaurants, fun money (random spending money) and toiletries. I use the cash envelope system from Dave Ramsey.

Cash has a lot of benefits, however, you need to stay disciplined. It is easy to spend cash for items you didn’t budget, then your cash disappears and you don’t have what you need! Typically, if I come across something I didn’t budget, I try to use my card because then it is noted that I didn’t budget the item in and makes it obvious. Pulling cash from different categories will backfire in the end. So use cash for what you budget and nothing else.

Budgeting Tip #5: Set Goals To Work Towards

Motivate yourself to stick to your budget by setting goals. You could work towards paying off all your debt. Save for a vacation. When you budget money, you in a sense get to place it where you want. To stay motivated, work items into the budget that you want, along with the items you need of course. If money is too tight for vacation, try an extra $5 at the end of the month to go grab a cup of coffee at your favorite spot. Use that time to plan out the next months budget, you’ll begin looking forward to it!

If you are really struggling to make your budget work, consider big changes. Is your housing or car payment taking too much of your income? Be honest with yourself, sometimes we get over our head and to move forward we might need to make changes. Removing the stress of financial burdens is a huge weight to be lifted!

I’ve been on all sides. I owned a house at 23, all by myself. It was a huge responsibility and why I paid the mortgage each month, money was super tight. I remember walking into the grocery store and counting out how much money I had in my purse, down to the coins to buy food that would last the longest. I didn’t expect the $300 heating bills and then one fateful Friday I lost my job. Now the Lord completely provided for me and within a week, I had transferred to the corporate office and never had a lapse in pay. However, I was in a little over my head. My housing cost was too much, even though I could “afford” it. It wasn’t long though before I was married and then my husband and I owned two houses, but that’s a whole other story!

The bottom line, we can never plan for everything…but we can’t ignore the fact that a rainy day is coming. Getting yourself in a good financial position removes an incredible amount of stress. Stress in your marriage, stress at work and stress with your kids. Finances can bring a lot of stress! If you are there, it doesn’t always have to be that way. Begin making changes, even if they are little.

If you need more specific help, check out my post How To Create a Budget.

In this post, I go a little more into the details and lay out some of the spending percentages to keep a healthy budget (modeled after The Dave Ramsey Total Makeover Program).

I hope these tips will help you get on track and stay motivated to reach your goals! Thanks so much for checking out my post!