How To Create A Budget

A big misconception about budgeting is you think you won’t be able to get what you want. In reality, a budget simply accounts for the money you earn and then allows you to choose where it goes. Let me share how much budgeting has truly helped us.

About 12 years ago a book landed into our hands, Dave Ramsey’s Total Money Makeover. We were two young professionals…making a good deal of money with a little debt. A house, a car, school loans (about $20,000 in school loans) and maybe one small credit card. We had no issues paying our bills, but the thought of financial freedom was very appealing to both of us! We started budgeting and the debt started to snowball (which if you get the book, you’ll see is a good thing!). 11 months later we had paid off over $30,000 in debt and the only thing left was our mortgage payment.

What we didn’t know, is how much that would change our entire future! Shortly after we paid off all our debt, we had our first child. He was born with a Giant Congenital Nevus, which needed to be removed. Since it was a giant classification, it would need to be removed in small portions over several surgeries. If it wasn’t removed it would have a high likelihood of turning to Melanoma.

Our son’s first surgery was at 3 months old, then 6 months, then 9 months, then 14 months…and they continued on and on. After 10 years, he had been through 18 surgeries! Thankfully, all the biopsies were negative and he was overall healthy! We had great medical insurance, but as you can imagine we still had lots of medical bills to pay.

We paid cash for every single bill in full. Sure, we had to sacrifice vacations, house projects that needed to be done and so many other things. However, it was amazing to see how one decision changed so much. If we didn’t make the decision to pay off all of our debt, today would look so much different!

I am sure we would have been drowning in debt and definitely not 9 years from paying off our house! Budgeting does way more than just telling you what to pay each month. It can change your financial future and take so much stress out of your life!

If you are already drowning, you don’t have to live with a financial burden forever! You can plan for a rainy day and learn to budget. So how do you do it? Let’s find out!

{This post may contain affiliate links, which means I may receive a commission if you click a link and/or purchase}

Click on the image to purchase!

How To Create A Budget

I am obviously a huge Dave Ramsey fan! He understands finances inside and out, but still gives it to you in terms you can understand! He has a free online tool at www.everydollar.com where you can start a budget. This is a great tool, especially if you are new to budgeting.

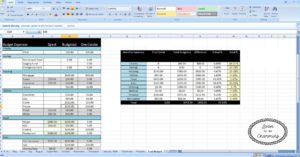

I happen to use a customized excel sheet for our budget, mainly because we have been budgeting long before the every dollar website existed. However, it is completely based off of the Dave Ramsey budget and set up very similarly.

If you would like to see a sample budget, I threw in some numbers below so you could see what it looks like.

Here is the Every Dollar Website, just to give you a peek.

Before every month my husband and I create a budget. We try to consider all the expenses for the following month, such as birthday gifts, school functions, or events we might need money for. If this seems overwhelming just remember the more you do it, the easier it will get.

To help remember everything you need to budget, I started making notes during each month for the things I forgot to budget. So the following year, I would have a better idea of what to budget.

Step 1: Break Your Budget Down Into Categories

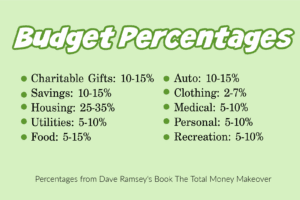

To begin a budget, start by figuring out your monthly income. Since you don’t want to spend more than you make, your monthly income becomes your budget. Now to make sure your expenses fit within your income. Dave Ramsey suggests the following categories in his book The Total Money Makeover: charitable gifts, saving, housing, utilities, food, transportation, clothing, medical/health, personal, recreation, debts. Break your expenses down into each of these categories.

Step 2: Write Out Your Own Budget

Pull out your bills and start writing out your monthly expenses or go online to Dave Ramsey’s website at www.everydollar.com and begin making a budget. Try to find accurate numbers for all your expenses. If you love excel, make a budget sheet for yourself like I did. Customize it to fit your needs.

Step 3: Check Your Percentages

Part of keeping a budget is seeing how much money you spend in each area. It is a great way to stay on track or to make sure you don’t get yourself in a tight situation. The percentages recommended by the book The Total Money Makeover are the following:

(To find the percentage…divide the amount you spend in each category by the total budget amount. For example if I place $200 into savings every month and my total monthly budget is $2000…the percentage I put towards savings would be 200/2000= .1 or 10%)

Once you make your budget, it will give you a clear idea what needs to be adjusted. If your recreation is way above 10% of your income, it would be a good area to cut back. When buying a house or finding an apartment, keeping your rent or mortgage within 25-35% of your income is really important. If you find that your housing or vehicles are way above that percentage, it may be time to consider moving or selling.

Step 4: Use Your Budget

It takes a little time to get used to planning everything out, so don’t be hard on yourself if you forget to budget something in. Make a note and move forward. The more you do it, the more you will get a handle on what you should spend and where. With every passing month you are on a budget, you will feel more empowered!

On our budget I also created a long term savings area. This is for saving up for larger things such as car repairs, large house projects or anything else not paid monthly like trash and water. It accumulates funds instead of washing them out every month if not spent.

I love budgeting and crunching numbers. When you spend money you have allocated towards something…it feels so much better than hoping you can afford it. When you sit down with your spouse and make goals, it gives you direction. Your goals can inspire you to change.

We are about 9 years away from paying off our house and being completely debt free! After that, the possibilities are endless. The same goes for you!

Thanks for checking out my post!

I love this post. I mastered a budget a couple years ago and I always chuckle when I remember my blog post about it bc I put fake numbers in as an example and everyone flipped out and was like Just $500 on rent?! THATS UNREALISTIC. I was like omg did u not read the disclaimer? lol

That’s hilarious!! I know it is always hard to do a sample budget. Thanks for your comment!